Home  Alumni & Giving

Alumni & Giving  Welcome to Planned Giving

Welcome to Planned Giving  Ways to Give

Ways to Give  Gifts That Protect Your Assets

Gifts That Protect Your Assets  Nongrantor Lead Trust

Nongrantor Lead Trust

Nongrantor Lead Trust

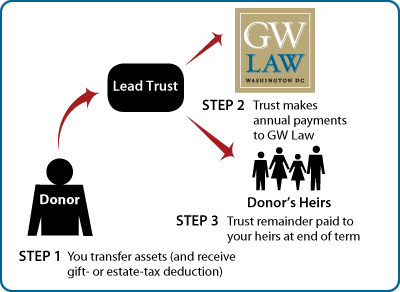

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years) and transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes annual payments to GW Law

- Remainder transferred to your heirs

Benefits

- Annual gift to GW Law

- Future gift to heirs at fraction of property's value for transfer-tax purposes

- Professional management of assets during term of trust

- No charitable income-tax deduction, but donor not taxed on annual income of the trust

Next Steps

© Pentera, Inc. Planned giving content. All rights reserved.

- Welcome to Planned Giving

- Legacy Challenge

- Ways to Give

- What to Give

- Gift Intention Form

- Most Popular Options

- Heritage Society

- Donor Stories

- Life Stage Gift Planner™

- Compare the Options

Resource Center

- Featured Article

- Glossary

- Bequest Language

- Securities and Wire Transfers

- Request eBrochures

- Newsletter Sign-Up

- Contact Us

- Disclaimer

2000 H Street, NW

Washington, DC 20052

p - 202.994.1010

f - 202.994.8980