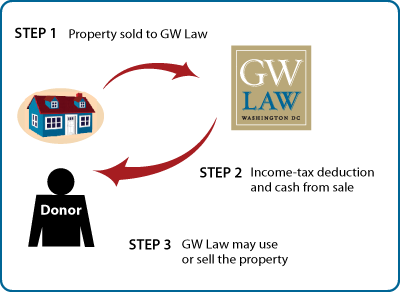

Real Estate—Bargain Sale

How It Works

- You sell property to GW Law for less than its fair-market value—usually what you paid for it

- GW Law pays you cash for agreed sale price, and you receive an income-tax deduction

- GW Law may use or sell the property

Benefits

- You receive cash from sale of property (sale price is often the original cost basis)

- You receive a federal income-tax deduction for the difference between the sale price and the fair-market value of the property

- GW Law receives a valuable piece of property that we may sell or use to further our mission

Next Steps

© Pentera, Inc. Planned giving content. All rights reserved.

- Welcome to Planned Giving

- Legacy Challenge

- Ways to Give

- What to Give

- Gift Intention Form

- Most Popular Options

- Heritage Society

- Donor Stories

- Life Stage Gift Planner™

- Compare the Options

Resource Center

- Featured Article

- Glossary

- Bequest Language

- Securities and Wire Transfers

- Request eBrochures

- Newsletter Sign-Up

- Contact Us

- Disclaimer

2000 H Street, NW

Washington, DC 20052

p - 202.994.1010

f - 202.994.8980